- Katie Oelker lives in Minneapolis, Minnesota, with her husband and two kids.

- Oelker, 33, is a financial coach, blogger, and podcaster. Her husband, 35, works in sales at a technology company earning a six-figure salary.

- For Business Insider’s “Real Money” series, Katie tracked their spending for a week.

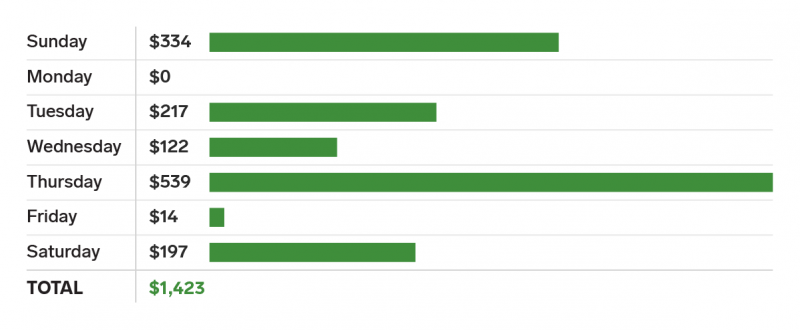

- During the week, they spent a total of $1,423 on a big hospital bill, grocery delivery from Costco, and monthly subscriptions.

- Want to share a week of your spending? Email [email protected].

I caught the FIRE (Financial Independence, Retire Early) bug earlier this year, and have been obsessed with becoming debt free since.

I’m not really all that into “retiring” early at this point, being that I have my own business and love what I’m doing, but I do love the idea of not owing anyone money. It definitely drives the way I use and view money.

Growing up, I was taught about money early on. My mom got me my first credit card at age 16 so I could use to pay for gas once a month and start establishing a credit score. She also bought me “The Money Book for the Young, Fabulous and Broke” by Suze Orman when I was in college, and I was hooked. After college, my dad told me to open a Roth IRA and fully fund it. I didn’t know exactly what I was doing, but I’m glad I started when I did as saving that early made it possible to buy our first home.

My husband works at a local Minneapolis technology company in sales and makes a six-figure salary, which is great as it allows me to stay home with our kids, a two year old and a five month old.

I never figured I was the type to want to stay home, but I love it (most days). I know it’s not for everyone and it certainly hasn’t always been easy financially, but we can make it work and I’m grateful that I’m able to build my business with my babies at home.

I recently started my financial coaching practice back up after baby No. 2 and work around the kids' nap schedules and on evenings. It's chaotic but I love it. I also blog about personal finance matters and run a podcast geared towards women called Financially Free Females. I used to teach business education courses at the high school level and was a financial planner for a few years before calling it quits to stay home and do my own thing, so what I'm doing now is a great intersection of these worlds.

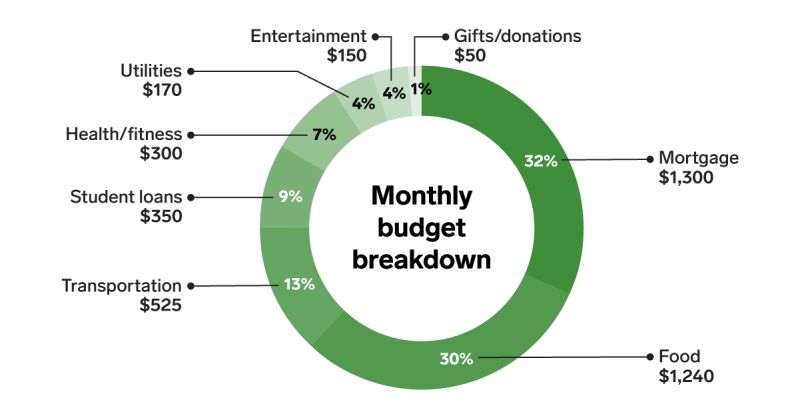

Our biggest monthly expenses are our mortgage, food, and transportation.

I've got it in my head that I want to be "debt free by 40," partly because it rhymes and yes, I'm a nerd like that. That's seven years away for me - I'm 33 and my husband is 35 - which would make our mortgage length a total of only 12 years.

Our current debt total is $179,322, which includes $5,569 in student loans, $5,517 on our car loan, and $168,182 on our mortgage.

Once we are done paying our remaining car and student loans off, which we should be able to do within the next few months, we can put an additional $800 a month or so toward our mortgage.

By throwing extra bonus money my husband gets at the principal throughout the year, we should be able to manage it. That is if we don't buy a different house, which we have been considering. We'd love to have more space as our family now includes a large dog and two kids, but dang - this low mortgage and the possibility of being debt free is so enticing.

When we bought our home five years ago, my husband and I did so figuring we could pay for it off of one income, mainly because we both liked the idea of not being house broke.

We love to travel too, and we're saving for a trip to Australia next year.

Before we had kids we would take one longer trip per year and travel is still really important to us. We've been to Australia, Ireland, Mexico, and Seattle, Vancouver, and Whistler, among a few other domestic destinations together, and have always preferred to spend our money on experiences and travel versus on things.

It can be tricky to balance short term goals (like travel to see friends) vs. long term goals (like paying off debt) but we try to enjoy the present while we set ourselves up for future success.

Another big financial goal we have is to visit some friends in Australia for Christmas in 2020. That will mean paying for three tickets overseas (the youngest will be under two years old and can still fly for free hopefully), which run roughly $2,000 a ticket.

I have been partaking in the ChooseFI credit card travel hacking program to try and rack up as many miles as I can before then and the rest we will plan to save for. We went to Australia on our honeymoon and I've been twice since I studied abroad there. That country and its people hold a special place in my heart.

It was an above-average week of spending, thanks to hospital bills and dining out.

Overall, it was an above average spending week for us thanks to hospital bills, entertainment, and eating out, but nothing that was completely unexpected. Tracking our spending is not something new to us and helps us understand what we've spent plus what we have left to spend.

This is the No. 1 behavior that helps keep us on track for our spending and saving goals, and I always have my clients do the same to bring awareness and change to their own financial situation.

On Sunday I made it to my first yoga class post baby No. 2.

I had one yoga class left on my punch card so I didn't have to pay, but I did rent a mat for $2. As an instructor I used to have tons of mats lying around, but I almost always end up renting one as I can't seem to find any these days and haven't gotten around to buying a new one. It felt so good to be back in the studio! I need to try and find more time to get to class.

Sunday was also the day when a lot of subscription payments went through for Amazon and DoTerra, an essential oils company I like. I typically spend about $20 a month on new essential oils or products as I prefer to use more natural alternatives for health and around the home.

My husband and I also had every intention of cooking dinner that night, but when he opened the package of chicken he mentioned that it smelled so he tossed it out. No thank you, food poisoning. Instead we ended up heading to a new local Mexican restaurant and enjoyed a nice little dinner with just our family of four, which doesn't happen very often.

This was a high spend day as my husband paid for his Fantasy Football League and I ordered business cards for the financial conference, FinCon 2019. I applied for a scholarship to attend for my coaching and blog/podcast brand, and won one!

Monday was a zero-spend day, which was great after paying for so many things the day before.

My husband brought steak taco leftovers from when we grilled over the weekend for lunch, and I made bolognese with Italian sausage for dinner.

Food is always our highest expenditure each month, as we love buying organic and local produce and meat, and enjoy eating out at local restaurants when we can.

I love the idea of "no spend days" and actually run challenges with my clients to see how many days they can go without spending money within a week's time. If you're competitive like me, it's certainly motivating.

During the girls' naptime, I snuck out to do a little lounging in the hammock. We've got a lot of big mature trees around and it's so peaceful to just relax out there and look up at the sky. It definitely doesn't happen very often and with a lot of traveling coming up it was a much needed de-stresser.

More subscriptions went through on Tuesday, including my monthly chiropractor and our Audible payment, and I went shopping with the baby.

On Tuesdays, my mom watches our oldest for a few hours so I can work. After wrapping up a podcast interview and client call at 5:30, I ran out to make a few returns and do some shopping with the baby as my husband was going to be gone late. I bought two new pairs of boots, two puzzles, two books, and three sweaters for my oldest at a local kids consignment shop for only $26 - such a deal! I seriously love what you can find thrift shopping.

I also headed to Target to make a few exchanges and check out some pants. I'm at that five-month postpartum stage where all my maternity pants are now too big (hooray!) but my regular pants are still too small. I would normally just make do with the maternity pants but being Fall has officially arrived here in Minnesota and I'm gearing up to do some traveling to Washington, DC and Colorado this month, I wanted some pants that actually fit.

Imagine my pleasant surprise when I realized that Target now sells jeans that are Fair Trade Certified! I love that they are moving in the direction of supporting brands that are practicing sustainable employment practices. I ended up grabbing two pairs of jeans that were on sale for $15 a pair.

In addition to the brick-and-mortar shopping I did, I also bought some printer ink and an SD card on Amazon. Seriously, what did we do before Amazon?

We buy ink for our home printer maybe every other year, so that's a very rare occurrence. The SD card will be used for when I record a podcast episode at this year's FinCon, which I'm really looking forward to.

On his way home from work, my husband picked up dinner from one of the only fast food places we will eat at - Raising Cane's. Their chicken fingers and homemade lemonade are just so good.

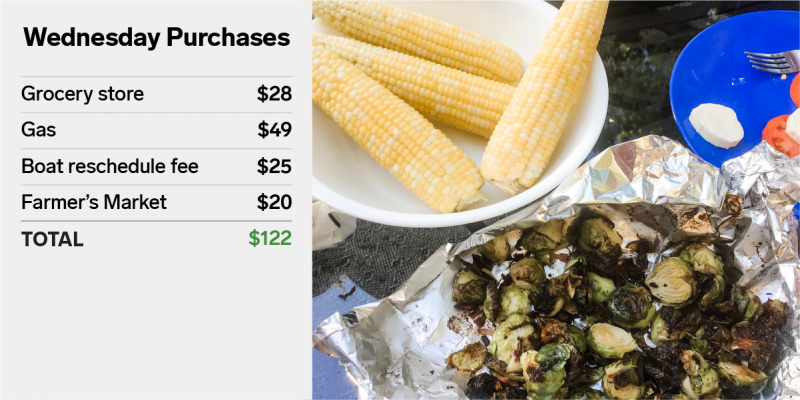

On Wednesday, I was at home with our girls as usual and after nap time we went out to get some gas and run to the local farmer's market.

I bought some tomatoes, corn, zucchini, broccolini, onions, and carrots for only $20. I love being able to support local farmers and try to stop at least every other week in the summer to load up.

After the farmer's market we stopped at the grocery store to buy a few items. I don't normally grocery shop during the week, especially with the girls, but we forgot a few things over the weekend and it's cheaper to go pick up items than it is to eat out.

I also paid for a boat reschedule fee. We were gifted a boat rental on the lake in our town (there are actually three lakes within walking distance of our home!) and rescheduled it for Labor Day weekend.

That night we made up some of the veggies I bought, including the cauliflower and brussels sprouts from the market the week before and the mozzarella I bought at the store. My husband is a fantastic cook (better than myself!) so it's just as much of a treat for me when we cook at home.

Thursday morning I took the dog and girls for a walk to the park, which is a common morning activity for us.

When both of them were napping, I paid one of the hospital bills we have. Our second daughter came via an unexpected C-section delivery and was in the NICU for a few days afterwards, so those bills have been slowly making their way in. Luckily we put quite of bit of money in our flexible spending account (FSA) this year knowing we'd be paying higher than average medical bills.

My husband is a high school football coach so we went to the game on Thursday night. I bought a few waters and a Starburst candy for my nephew.

Football season is fun, but we tend to get takeout or eat out more during this time due to long days and nights. As much as I can, I menu plan and grocery shop on the weekend so we limit buying food outside of the home.

Friday morning, my mom took our oldest for a few hours and my husband worked from home.

During his lunch break we ran out to look at a house for sale in our area that we both liked. But after touring we decided it was more than we wanted to spend for what was offered. Again, the whole "should we stay or should we move" conundrum!

After we got back, I took the baby and dog on a walk to a local sub/ice cream place. I never eat out for lunch during the week, but I treated myself to a small cone and got a sub sandwich for myself and my husband. The total came to $11 and I tipped $3 as I used to work in a similar place in college and loved getting those tips.

That night I made a homemade pizza with the farmer's market tomatoes, fresh mozzarella we got from the store, and basil we grow in our herb garden.

Saturday morning I woke up and did some yoga outside with the dog and ordered some groceries and home essentials to be delivered from Costco.

I love being able to use Instacart for Costco as I wouldn't dare go there on a Saturday otherwise!

My mom watched the girls while we went out on the boat, which was super nice of her and saved paying for a sitter. We had a great time cruising the lake and relaxing with our friends. There are usually six kids among us six adults when we get together, so it was nice to be able to actually have conversations for a change!

We decided to pick up some Asian takeout on the way home and enjoyed it with our two year old who loves eating "noods" (noodles) and "pots" (potstickers).

- Read more from our Real Money series:

- My husband and I are taking a 3-year 'mini-retirement' in our 30s. Here's what a week of spending looks like for our family of 7

- I'm a dad and a business owner in my 30s with a 6-figure income - here's how I spent my money during a recent week

- My husband and I live in Seattle and save almost half our income so we don't have to work by 40. Here's what we spend in a typical week.

- I retired at 52 with a $3 million net worth - here's what a week of my spending looks like